NBZ NV: Dutch Shipping Investment Fund

Introduction

Nederlandse Beleggingsmaatschappij in Zeeschepen (“NBZ”) is a dedicated shipping investment fund that was founded in 2006. The company is listed on the Amsterdam Stock Exchange as from 2011. NBZ investments are diversified over various shipping markets, such as the dry bulk market, the multipurpose market, the container market, the product tanker market and the gas tanker market. Currently all the NBZ investments are financially structured with adequate security arrangements such as Time Charters and Bareboat (put/call) arrangements. It is the objective to pay to out dividend twice a year (approx. 7 – 10% p.a.) in stock or in cash (on request).

Shares

- NBZ is a closed-end investment fund. Shares are traded at Euronext.

- NBZ invests in US dollars. The stock exchange listing and dividend payments are in euros.

- NBZ distributes dividend twice a year, in June and December.

Listing Agent: ING Bank

Ticker symbol: NBZ

ISIN: NL0010228730

Nederlandse Beleggingsmaatschappij voor Zeeschepen NV

World Trade Center, G-Toren

Strawinskylaan 485

1077 XX Amsterdam

Postbus 79032

1070 NB Amsterdam

T: +31 (0)20 572 01 01

F: +31 (0)20 572 01 02

Focko Nauta (tel: +31 6 29037887)

Chamber of Commerce in Rotterdam: 24392701

Downloads

- Quarterly report Q3 2023

- Semi-annual report 2023

- Quarterly report Q1 2023

- Annual results 2022

- Quarterly report Q3 2022

- Semi-annual report 2022

- Quarterly report Q1 2022

- Annual results 2021

- Quarterly report Q3 2021

- Semi-annual report 2021

NBZ Background

NBZ was founded in 2006, during the first years as a private company before it went public in 2011. The main objective was to create a diversified portfolio with investments in various types of vessels with long term employment in different market segments. This was a totally new concept in the Netherlands, where the local shipping investment market was dominated by limited partnerships with single-ship companies without any long term employment for the vessels involved and 90% of the vessels being newly (most Dutch) built short sea multipurpose vessels.

Annexum Beheer B.V. is responsible for the general management of NBZ, mainly focusing on the compliance and administration. Focko Nauta is responsible for the day to day operation and investment management.

Investment criteria

The investment strategy of NBZ is clearly described in the latest prospectus. It is the ambition of the management to create shareholders value on the longer term and to pay out dividend regularly (approx. 7 – 10% p.a.) .

The investment criteria of NBZ are herewith summarized as follows:

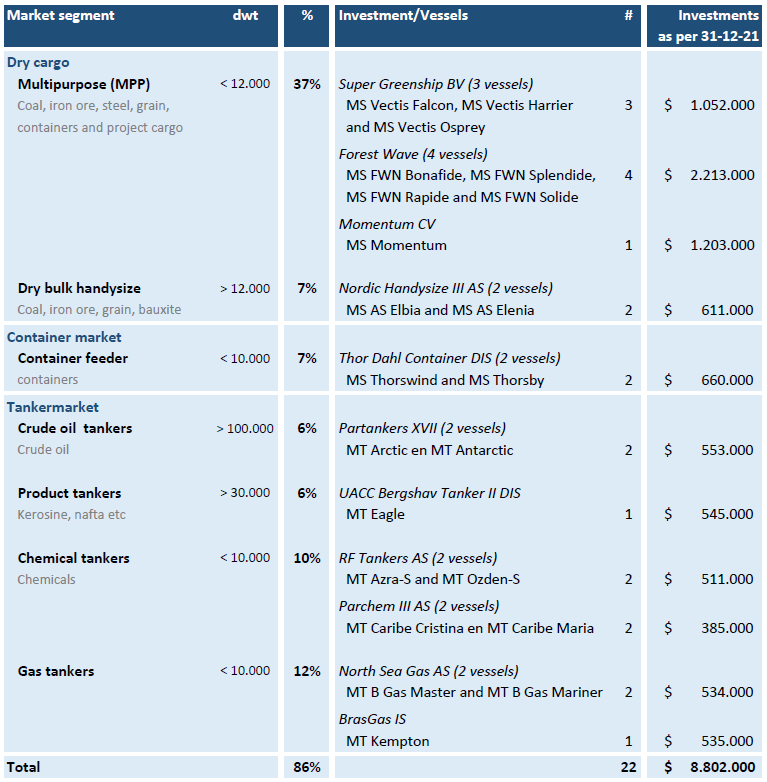

- Investments are in different types of vessels operated in different segments of the shipping market. Per the end of 2020 the NBZ portfolio is diversified over 22 vessels (divided over 10 investments) in 6 markets.

- Vessels have fixed adequate employment with reliable counterparts or are secured by mortgages. Investments preferably include secured exit scenarios. Currently (end 2020) 5 of the 10 investments include exit price agreements.

- All vessels are existing seagoing vessels; no new buildings.

- New investments should be able to generate 12% return on investment (IR).

The available capital for investments is limited. In order to be able to maintain the necessary diversification objective, most of the investments include minority participations in limited partnerships. Currently 8 of the 10 investments are participations in Norwegian limited partnerships. Investments are often structured as buy and charter transactions. Currently, 50% of the investments include bareboat contracts, meaning that the vessels are chartered as bare hulls and lessors are responsible for maintenance, crew and insurance.

Investment proposals are prepared by the management and submitted to the Supervisory Board for final approval. Investment proposals include amongst others thorough analysis of the market involved, the parties involved, the residual value risks and the return on investment calculations.

Investment portfolio of NBZ

The investment portfolio NBZ as per 31 December 2021:

Governance

It is important to have open communications with our shareholders. We keep our shareholders abreast of fund developments on our website but also by quarterly messages and our quarterly and annual financial reports.

General Meeting of Shareholders

The ultimate power within NBZ lies with the investors in NBZ. The most important tasks of the General Meeting of Shareholders are, among others, the election of the Supervisory Board and the adoption of the Annual Accounts.

Management

Annexum Beheer BV has been registered and AFM licensed and is entitled to act as Manager. The AFM, the Netherlands Authority for the Financial Markets in Amsterdam supervises the behavior of everyone operating on the market with respect to saving, lending, investing and assurance.

Supervisory Board

The Supervisory Board supervises the policy pursued by the management, taking account of the interests of all the company's stakeholders. All investment proposals need to be approved by the Supervisory Board. Bote de Vries is chairman of the Supervisory Board and Robert Verburgt is member of the Supervisory Board.

Wat is NBZ?

- Een beleggingsfonds in zeeschepen.

- Het fonds financiert meerdere schepen, die op verschillende markten actief zijn.

- Dankzij deze spreiding beheersbaar risico.

- Streef dividend tussen 7% en 10% per jaar.

Koers NBZ

Intrinsieke waarde

31 maart 2024

USD 1,36

€ 1,27

Beurskoers

Actuele koersinformatie

ISIN NL0010228730