NBZ NV: Dutch Shipping Investment Fund

Introduction

Nederlandse Beleggingsmaatschappij in Zeeschepen (“NBZ”) is a dedicated shipping investment fund that was founded in 2005. The company is listed on the Amsterdam Stock Exchange as from 2011. NBZ investments are diversified over various shipping markets, such as the dry bulk market, the short sea multipurpose market, the product tanker market and amongst others the gas tanker market. Currently all the NBZ investments are financially structured with adequate security arrangements such as operational and financial leases (supported by long term vessel employment) and/or 1st priority mortgage security.

NBZ background

NBZ was founded by Diederik Tjeenk Willink in 2005, during the first years as a private company before it went public in 2011. The main objective was to create a diversified portfolio with investments in various types of vessels with long term employment in different market segments. This was a totally new concept in the Netherlands, where the local shipping investment market was dominated by limited partnerships with single-ship companies without any long term employment for the vessels involved and 90% of the vessels being newly (most Dutch) built short sea multipurpose vessels. Annexum Beheer B.V. is responsible for the general management of NBZ, mainly focussing on the compliance and administration. Focko Nauta is responsible for the day to day operation and investment management.

Investment Criteria

The investment strategy of NBZ is clearly described in the latest prospectus (2016). It is the ambition of the management to to create shareholders value on the longer term and to pay out dividend regularly (approx. 7 – 10% p.a.).

The investment criteria of NBZ are herewith summarized as follows:

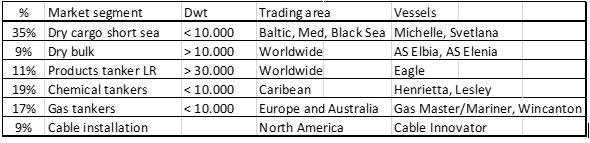

1) Investments are in different types of vessels operated in different segments of the shipping market. Per the end of 2017 the NBZ portfolio is diversified over 11 investments in 6 markets.

2) Vessels have fixed adequate employment with reliable counterparts and/or are secured by mortgages. Investments preferably include secured exit scenarios. Currently (end 2017) 8 of the 11 investments include exit price agreements and one investment is secured by a 1st priority mortgage. Two investments include open sales scenarios.

3) All vessels are existing seagoing vessels; no new buildings.

4) Investments must meet certain return requirements.

The available capital for investments is limited. In order to be able to maintain the necessary diversification objective, most of the investments include minority participations in limited partnerships. Currently 9 of the 11 investments are participations in Norwegian limited partnerships. Investments are often structured as buy and charter transactions. In most of the cases the charter contracts are bareboat contracts, meaning that the vessels are chartered as bare hulls and lessors are responsible for maintenance, crew and insurance.

Investment proposals are prepared by the management and submitted to the Supervisory Board for final approval. Investment proposals include amongst others thorough analysis of the market involved, the parties involved, the residual value risks and the return on investment calculations.

Governance

It is important to have open communications with our shareholders. We keep our shareholders abreast of fund developments on our website but also by quarterly messages and our quarterly and annual financial reports.

Supervisory Board

The Supervisory Board supervises the policy pursued by the management, taking account of the interests of all the company's stakeholders. All investment proposals need to be approved by the Supervisory Board. Bote de Vries is chairman of the Supervisory Board and Jaap Koelewijn is member of the Supervisory Board.

General Meeting of Shareholders

The ultimate power within NBZ lies with the investors in NBZ. The most important tasks of the General Meeting of Shareholders are, among others, the election of the Supervisory Board and the adoption of the Annual Accounts.

Dividend policy

Dividend is paid in advance in the form of quarterly interim dividend.

Listed on the Amsterdam Stock Exchange. The AFM, the Netherlands Authority for the Financial Markets in Amsterdam supervises the behaviour of everyone operating on the market with respect to saving, lending, investing and assurance. The AFM is advising everyone involved in financial dealings with a financial institute, to check the Institutes Register for securities services. Annexum Beheer BV has been registered there and is entitled to act as Manager.

Investment portfolio of NBZ

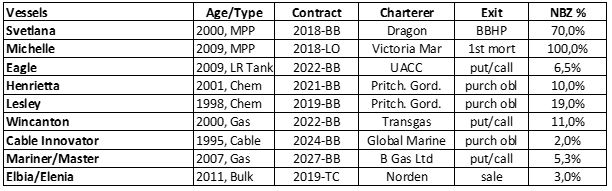

The current NBZ portfolio includes the following investments (May-2018):

-1 Svetlana. The Svetlana is a multipurpose dry cargo vessel of 8.000 dwt, built in The Netherlands and delivered in 2000. NBZ is 70% owner of the Svetlana, The charterer (Dragon) has an option to buy the vessel for Usd 1 at the end of the 4 years charter, summer 2018. The vessel is operated in the Black Sea and Mediterranean area. NBZ exposure per the end of 2017: Usd 350K.

-2 Michelle. The Michelle is a multipurpose dry cargo vessel of 8.000 dwt, built in China and delivered in 2009. NBZ provides a loan, secured by a first priority mortgage. The vessel is operated in the Black Sea and Mediterranean area. NBZ exposure per the end of 2017: Usd 1,300K.

-3 Eagle. The Eagle is a long range product tanker of 74.000 dwt, built in China and delivered in 2009. NBZ is 6,5% owner of the vessel. The charterer has taken the vessel on a 5 years bareboat contract until December 2022. The Vessel operates world-wide. The bareboat charter contract includes put and call options. NBZ exposure per the end of 2017: Usd 550K.

-4 Henrietta. The Henrietta is a chemical tanker of 10.000 dwt, built in The Netherlands and delivered in 2001. NBZ is 10% owner of the vessel. The charterer (Pritchard Gordon) has taken the vessel on a 6 years bareboat contract until November 2021. The vessel mainly operates in the Caribbean. The bareboat charter contract includes put and call options. NBZ exposure per the end of 2017: Usd 600K.

-5 Lesley. The Lesley is a chemical tanker of 6.250 dwt, built in The United Kingdom and delivered in 1998. NBZ is 19% owner of the vessel. The charterer (Pritchard Gordon) has taken the vessel on a 5 years bareboat contract until December 2019. The vessel mainly operates in the Caribbean. The bareboat charter contract includes put and call options. NBZ exposure per the end of 2017: Usd 350K.

-6 Wincanton. The Wincanton is a Gas Carrier of 9.200 dwt, built in Japan and delivered in 2000. NBZ is 11% owner of the vessel. The charterer (Transgas) has taken the vessel on a 5 years bareboat contract until July 2021. The Vessel mainly operates in Australia. The bareboat charter contract includes put and call options. NBZ exposure per the end of 2017: Usd 350K.

-7 Cable Innovator. The Cable Innovator is a telecom cable layer, built in Finland and delivered in 1995. In May 2018 NBZ sold 50% of its 4% ownership in the vessel with a good profit in excess of 18%. The charterer (Global Marine) has taken the vessel on a 10 years bareboat contract until May 2025. The vessel operates in the United States and Canada. The bareboat charter contract includes a purchase obligation at the end of the charter period. NBZ exposure per the end of 2017: Usd 400K (after the sale per May-2018: Usd 200K).

-8,9 Gas Mariner, Gas Master. The Gas Mariner and the Gas Master are Gas Carriers of 3.400 dwt, built in Turkey and delivered in 2007. NBZ is 5,25% owner of the vessels. The charterer (B Gas) has taken the vessel on a 10 years bareboat contract until May 2027. The bareboat charter contract includes a put and call options at the end of the charter period. The vessels are operating in North West Europe. NBZ exposure per the end of 2017: Usd 450K.

10,11 Elbia, Elenia. The Elbia and the Elania are Handysize Bulk Carriers of 35.000 dwt, built in Korea and delivered in 2011. NBZ is 3% owner of the vessels. The charterer (Norden) has taken the vessel on a 2 years time charter contract until November 2019. The time charter contract does not include any options at the end of the charter period. The vessels are operating worldwide. NBZ exposure per the end of 2017: Usd 450K.

Market diversification as per end 2017:

NBZ Financial information

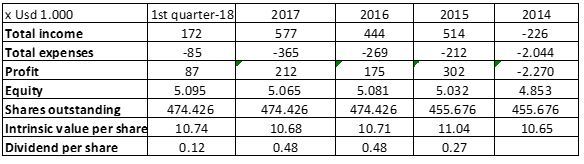

As from April 2015 onwards, NBZ has been paying dividend each quarter.

Executive summary and future considerations

The NBZ investment criteria are based upon market diversification and long term employment for the vessel investments. One of the main objectives of NBZ in to create long term value for the shareholders, therefore the NBZ investments often include an exit downside protection mechanism (put option). This enables NBZ to show good results in good and bad times. The investment portfolio must generate sufficient cash return to enable NBZ regularly pay dividend to her shareholders.

NBZ has a lean and mean internal organisation and is managed by Annexum, one of the largest managers of private equity real estate projects in The Netherlands. Long term in-depth shipping and investment experience are represented in the day-to-day management team as well as in the Supervisory Board.

NBZ, being listed on the Amsterdam Stock Exchange maintains the highest reporting and corporate governance standards. Besides the ongoing efforts to keep the highest quality investment portfolio, NBZs main challenge during the coming years will be the strengthening of her own capital base.

Nederlandse Beleggingsmaatschappij voor Zeeschepen BV

World Trade Center / G Tower

Strawinskylaan 485

1077 XX Amsterdam

The Netherlands

Focko Nauta (tel: +31 6 29037887)

E-mail: fn@nbzfonds.nl

Chamber of Commerce in Rotterdam: 24392701

Wat is NBZ?

- Een beleggingsfonds in zeeschepen.

- Het fonds financiert meerdere schepen, die op verschillende markten actief zijn.

- Dankzij deze spreiding beheersbaar risico.

- Streef dividend tussen 7% en 10% per jaar.

Koers NBZ

Intrinsieke waarde

31 maart 2024

USD 1,36

€ 1,27

Beurskoers

Actuele koersinformatie

ISIN NL0010228730